The US banking crisis or contagion risk has drawn much attention

Beijing, May 14 (Xinhua) -- (International Observation) The US banking crisis or the risk of spillover concerns

Xinhua News Agency reporter Ouyang Wei

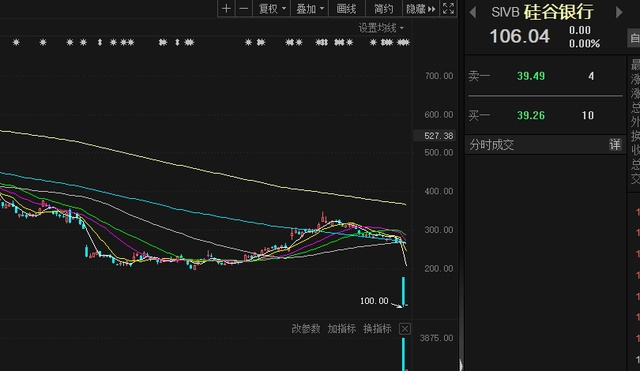

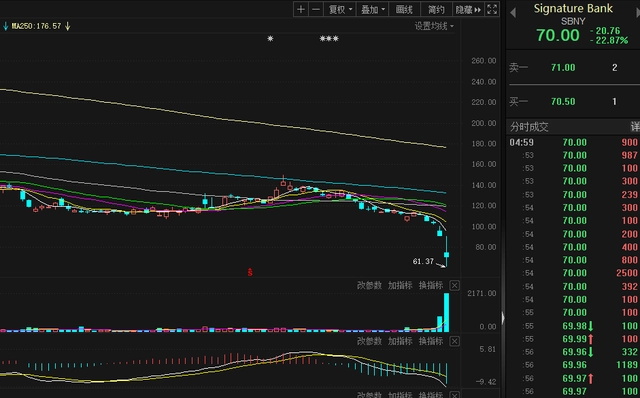

Pacific Western Banking Co., a regional bank, reported a significant drop in deposits at the end of the first quarter, sparking concern and sending its shares into a volatile session. Since March this year, the United States has Silicon Valley Bank, Signature Bank and First Total Bank went bankrupt.

At present, the American banking industry, especially the small regional banks, are facing such challenges as deposit loss, asset value shrinking and non-performing asset risk rising. In addition, the risk of default by the US federal government has added to the banking woes.

Experts warn that the crisis has not subsided, and may continue to spread and impact financial markets, its spillover risk is of particular concern.

U.S. commercial bank deposits totaled less than $17.2 trillion as of April 26, 2023, down about $600 billion from around $17.8 trillion in December, according to the Federal Reserve. Small commercial bank deposits fell from $5.63 trillion to $5.32 trillion, a decline of about $310 billion.

According to a survey conducted by Gallup in April, 48 percent of respondents said they were "very" or "somewhat" worried about the safety of their deposits in banks and other financial institutions, which is higher than the level in 2008 during the global financial crisis. Concerns about the safety of deposits among American businesses and households have led to a flight of deposits, on which banks rely most.

The loss of deposits will cause small and medium-sized banks to continue to increase the scale of financing and borrowing, increasing the cost of debt. To cope with the loss of deposits, many small and medium-sized banks have been forced to sell assets such as long-term bonds or borrow from each other at high interest rates or from the Federal Reserve to replenish liquidity.

Notably, US commercial real estate vacancy rates have risen, as have loan defaults. Once commercial real estate risk spreads, it will cause another blow to small and medium-sized banks. A storm is brewing in the US commercial property market and US banks are "awash in bad loans" as property prices fall, Charlie Munger, vice-chairman of Berkshire Hathaway, has said.

In addition, the risk of the federal government defaulting on its debt will add to the banking woes. On January 19, the federal government reached its legal debt limit of $31.4 trillion. At present, the Democratic and Republican parties of the United States over the debt ceiling of the party is intensifying, difficult to raise the debt ceiling issue to reach an agreement. A default by the federal government on some of its debt would send interest rates on Treasury bonds soaring, affecting the cost of auto loans, home mortgages and other borrowing and exacerbating the banking sector's woes.

Analysts believe that if the U.S. banking crisis continues to develop, it could drive banks to tighten credit, hurting investment in small businesses and private consumer credit in the United States, which rely on bank loans. The Fed survey also shows that bank credit growth has slowed at an accelerated pace since March.

The turmoil in the banking sector has also highlighted risks in the bond market, through which companies tend to raise funding costs. Against the backdrop of high federal funds rate, continued contraction of manufacturing sector and significant increase in financial risk aversion, the turmoil in the banking sector may become the last straw to overcome the US economy and increase the possibility of recession in the US economy, which has been sluggish in recovery.

Analysts say the banking crisis will also undermine the dollar's global dominance and credibility. Since 2007, the size of the Fed's balance sheet has soared from less than $1tn to more than $8tn, its asset structure has changed dramatically, and the real purpose of its balance sheet expansion has shifted from maintaining financial stability to spreading costs around the world. The current banking turmoil is the inevitable result of America's unlimited dollar credit.